Basic Concept and System Structure

Basic Concept of Corporate Governance

As an institution specializing in securities finance, the Company has a mission to contribute to the development of the securities market by proactively meeting the diverse needs of the securities and financial sectors and to enhance the long-term interests of users, while always maintaining a keen awareness of its public role. Based on this thinking, the Company aims to gain the firm trust of the society through sound business operations.

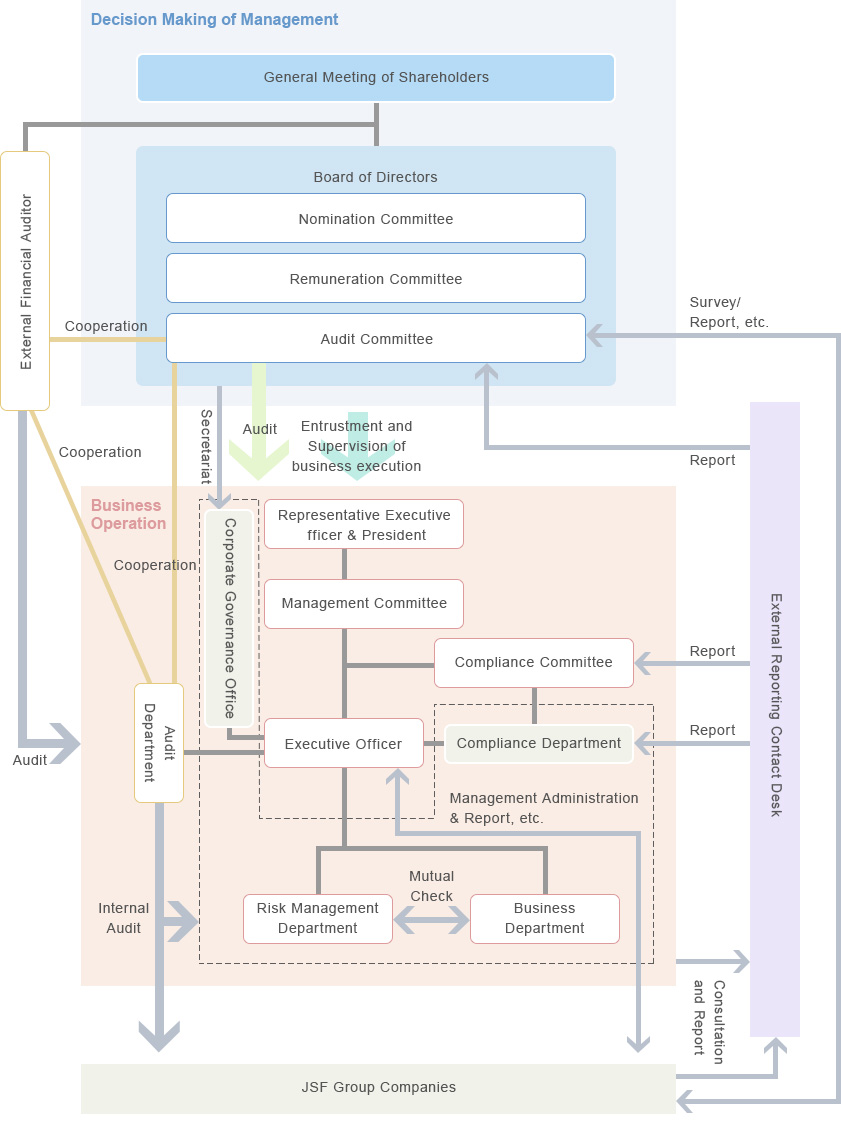

With this corporate philosophy, the Company has adopted “Company with Nominating Committee, etc.” as the structure under the Companies Act, based on which the Company will strive to clarify the separation of supervision and execution of business operations, to further strengthen supervision by mainly outside directors for ensuring the soundness of management, and to realize prompt business execution that responds quickly to change in the business environment.

With this corporate philosophy, the Company has adopted “Company with Nominating Committee, etc.” as the structure under the Companies Act, based on which the Company will strive to clarify the separation of supervision and execution of business operations, to further strengthen supervision by mainly outside directors for ensuring the soundness of management, and to realize prompt business execution that responds quickly to change in the business environment.

AdobeReader® is required to view this content.If this program is not installed on your computer, please click on the icon to the right to do so.

Overview of Corporate Governance

The Board of Directors

- The Board of Directors not only conducts the decision-making on basic management policy and other matters designated by laws and regulations, as well as important matters on business management, but also supervises the status of execution of duties of directors and executive officers.

- In order to enhance efficiency of business management and speed up execution of operations, the Board of Directors delegates the decisions on execution of operations other than the matters to be resolved by the Board of Directors designated by laws and regulations and the Articles of Incorporation to representative executive officers.

- The Board of Directors comprises a variety of directors with different expertise, experiences and other qualifications. The Company secures the appropriate number of the Board of Directors members at which the functions of the Board of Directors can be exerted most effectively and efficiently, to the extent designated in the Articles of Incorporation.

- Multiple outside directors independent from the Company shall be appointed to constitute the Board of Directors where it is expected that, through their advice and comments based on abundant experience and expert knowledge on business management and other issues, appropriateness of the Company’s business operations is secured and business management supervisory functions from external viewpoints are performed in an objective and neutral manner.

- In principle, the chairperson of the Board of Directors shall be an outside director.

| Organization structure | Company with Nominating Committee, etc. |

| Chairperson of the Board | Outside Director |

| Maximum Number of Directors Stipulated in Articles of Incorporation | 8 persons |

| Number of Directors | 7 persons |

| Number of Outside Directors (Number of Independent Directors) |

5 persons (5 persons) |

Three Committees

- The Nomination Committee not only determines the content of election of director candidates pursuant to laws and regulations, but also deliberates and determines the content of election and dismissal of directors, executive officers, the policy on election and dismissal of directors and executive officers, and other matters on election and dismissal of directors, executive officers and corporate officers of the Company in general.

- The Audit Committee not only audits the execution of duties of directors and executive officers, prepares audit reports and such, but also deliberates and determines the content of proposals on election and dismissal of accounting auditors for submission to the general meeting of shareholders and such.

- The Remuneration Committee not only determines the individual amounts of remuneration for directors and executive officers and determines the policy on determination thereof pursuant to laws and regulations, but also deliberates and determines the matters on remuneration for directors and executive officers of the Company in general.

- In principle, the chairperson of the Nomination/Audit/Remuneration Committee shall be an outside director.

◆Committee Membership◆

| Nomination Committee | Audit Committee | Remuneration Committee | |

| Chairperson | Naotaka OBATA | Shoko SUGINO | Naotaka OBATA |

| Member | Shoko SUGINO | Takayoshi YAMAKAWA | Shoko SUGINO |

| Kensuke FUTAGOISHI | Hiroshi ASAKURA | Kensuke FUTAGOISHI | |

| Takayoshi YAMAKAWA | Setsuko EGAMI | ||

| Shigeki KUSHIDA | Shigeki Kushida |

Reference. Naotaka OBATA, Shoko SUGINO, Kensuke FUTAGOISHI, Takayoshi YAMAKAWA, and Setsuko EGAMI are each outside directors.

Exectuive Officers

- The representative executive officers and executive officers determine the execution of operations and execute operations so delegated by the Board of Directors based on the segregation of duties and hierarchy of commands designated by the Board of Directors.

- The Company has established the Management Committee, which deliberates or determines important matters related to the execution of operations, among other matters.

About appointing Outside Directors

Outside directors are expected to ensure the appropriateness of company operations and provide objective, neutral, outside supervision of management through advice and comments based on their abundant experience in management and professional knowledge and expertise. They are in an objective position independent of the executive directors and have no potential conflicts of interest with general shareholders.

Furthermore, the Company has established the following criteria for independence in appointing outside directors and outside auditors.

Criteria for Independence of Outside Officers

The Company shall determine that, on top of the criteria for independence set forth by the Tokyo Stock Exchange, a person who falls under any of the following categories is not independent of the Company.

1. A person who currently falls under any of the following (1) through (5)

(1) Principal shareholder

- A person who is a principal shareholder of the Company (a shareholder holding shares that represent at least 10% of the total voting rights) or, if the person is a corporation, etc., its conducting representative

(2) Principal business partner

- A person for whom the Company is a principal customer (a person whose transaction amount with the Company accounts for at least 2% of the person’s consolidated operating revenues in the latest fiscal year) or, if the person is a corporation, etc., its conducting representative

- A person who is a principal customer of the Company (a customer with whom the Company conducts business for an amount that accounts for at least 2% of the Company’s consolidated operating revenues in the latest fiscal year) or, if the person is a corporation, etc., its conducting representative

(3) Experts, etc.

- Consultant, accountant or legal professional who receives monies or other economic benefits (excluding officers’ remunerations) amounting to 10 million yen or more per fiscal year from the Company or, if the person is a corporation, etc., its conducting representative

(4) Donation

- A person who has received donation from the Company for the amount of 10 million or more per fiscal year or, if the person is a corporation, etc., its conducting representative

(5) Close relatives

- A close relative (spouse or a relative within the second degree of kinship) who falls under the categories of (1) through (4) above

2. A person who falls under any of the categories in 1. at any time in the past three years

Outside Directors : Reason for Appointment

Outside Directors

| Name | Reason for Appointment |

| Naotaka OBATA | He has extensive experience in corporate management in the financial industry. Through his overseas business experience, he also has extensive knowledge and insight on international business development, and therefore, the Company has judged that he can be expected to play a sufficient role in the effective supervision of the Company's management and in decision-making on medium- and long-term management policies, etc., from an independent and objective standpoint as an outside Director. |

| Shoko SUGINO | As an attorney at law, she has extensive experience and knowledge in legal and compliance matters, as well as in internal control, sustainability, and corporate governance. The Company has judged that she can be expected to play a sufficient role in the effective supervision of the Company's management and in decision-making on medium- and long-term management policies, etc., from an independent and objective standpoint as an outside Director. |

| Kensuke FUTAGOISHI | He has extensive experience in the management of financial institutions with unique and leading-edge business models, as well as a wealth of knowledge and extensive insight on internal control and risk management. The Company has judged that he can be expected to play a sufficient role in the effective supervision of the Company's management and in decision-making on medium- and long-term management policies, etc., from an independent and objective standpoint as an outside Director. |

| Takayoshi YAMAKAWA | He has extensive knowledge and insight into trends in technological innovation related to DX, etc., as well as extensive experience in corporate management in the industrial sector. The Company has judged that he can be expected to play a sufficient role in the effective supervision of the Company's management and in decision-making on medium- and long-term management policies, etc., from an independent and objective standpoint as an outside Director. |

| Setsuko EGAMI | She has extensive knowledge and broad insight on human resource development, risk management, and corporate management. The Company has judged that she can be expected to play a sufficient role in the effective supervision of the Company's management and in decision-making on medium- and long-term management policies, etc., from an independent and objective standpoint as an outside Director. |

Policy regarding the remuneration of officers

Remuneration and such for the officers of the Company shall be based on systems and standards in accordance with the directors’ and executive officers’ roles and expected functions, in order to achieve sustained growth and enhancement of corporate value over the medium to long term based on the corporate philosophy and management policy. Specifically, the individual amounts of the remuneration and such shall be determined by the Remuneration Committee based on the following policy determined by the Remuneration Committee.

【Directors】

- With a view to having supervisory functions exerted, directors shall receive only the fixed monthly remuneration (base remuneration), and remuneration linked to the business performance and such shall not be provided to them.

- Individual directors’ remuneration shall be determined in accordance with responsibilities as directors, such as whether full-time or part-time and acting as chairperson.

- Directors concurrently serving as executive officers shall not receive remuneration as directors.

【Executive Officers】

- With a view to enhancing the correlation with the Company’s business performance and share value, the remuneration for executive officers shall comprise a fixed monthly remuneration (base remuneration), officers’ bonuses linked to business performance and share-based remuneration.

- The fixed monthly remuneration (base remuneration) shall be determined in accordance with each executive officer’s position.

- The officers’ bonuses shall be determined after the end of the fiscal year, in accordance with the status of achievement of management goals under the medium-term management plan and the business performance of each fiscal year, and are paid within 3 months after the decision is made, with the purpose of clarifying the responsibilities of management.

- As for the share-based remuneration, the Board Benefit Trust (BBT) scheme shall be used to provide points, which are determined in correlation with medium- to long-term business performances, to the executive officers, to whom the Company’s shares will be issued upon their retirement from office in accordance with the points.

Remuneration paid to Directors and Executive Officers (FY2022)

| Officer classification | Total amount of remuneration paid (¥ million) |

Total amount of remuneration paid by type of remuneration (¥million) | Number of officers (person) | ||

| Basic | Bonus | Stock-based | |||

| Directors (excluding outside directors) | 8 | 8 | -- | -- | 1 |

| Outside Directors | 61 | 61 | -- | -- | 5 |

| Executive Officers | 329 | 219 | 72 | 38 | 7 |