The Company’s approach to appointing its management team and developing internal human resources

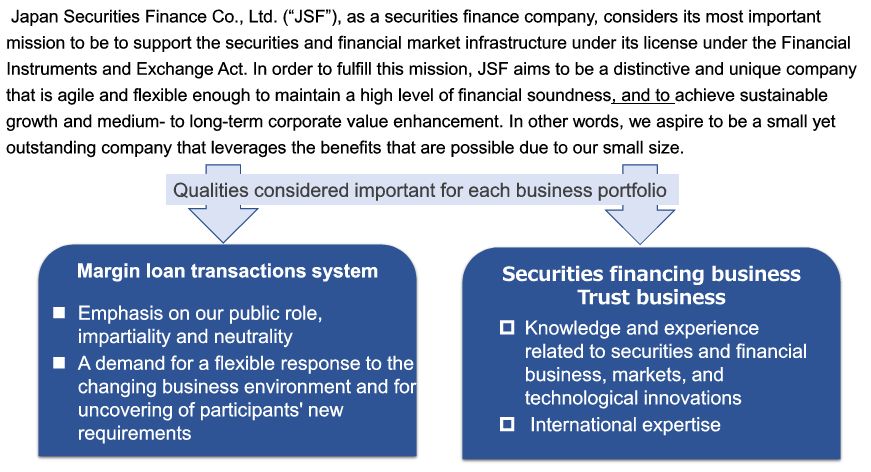

Japan Securities Finance Co., Ltd. (hereinafter “JSF”), as a securities finance company, considers its most important mission to be to support the securities and financial market infrastructure under its license under the Financial Instruments and Exchange Act. In order to fulfill this mission, JSF aims to be a distinctive and unique company that is agile and flexible enough to maintain a high level of financial soundness, and to achieve sustainable growth and medium- to long-term corporate value enhancement. In other words, we aspire to be a small yet outstanding company that leverages the benefits that are possible due to our small size

To ensure the realization of JSF's future vision, it is crucial to not only make efforts in pursuing each of our business portfolios, but it is equally important to appoint a management team who will oversee and lead these businesses and to develop internal human resources to achieve these goals.

JSF has been actively addressing the above issues, and four years have passed since the Company adopted the governance system as a Company with a Nomination Committee, etc. in 2019. At this time, as the Seventh Medium-term Management Plan begins in FY2023, we would like to address our progress to date and present our approach to future initiatives, along with the actual functioning of the Nomination Committee and the Board of Directors, in order to prepare for the future.

To ensure the realization of JSF's future vision, it is crucial to not only make efforts in pursuing each of our business portfolios, but it is equally important to appoint a management team who will oversee and lead these businesses and to develop internal human resources to achieve these goals.

JSF has been actively addressing the above issues, and four years have passed since the Company adopted the governance system as a Company with a Nomination Committee, etc. in 2019. At this time, as the Seventh Medium-term Management Plan begins in FY2023, we would like to address our progress to date and present our approach to future initiatives, along with the actual functioning of the Nomination Committee and the Board of Directors, in order to prepare for the future.

1. JSF's History in Strengthening Corporate Governance (Attachment 1).

From the outset, the Company has had a history of taking a strong interest in and being proactive about corporate governance since the time it was a Company with an Audit Committee. For example, in FY2015, the Company appointed a female outside Director, and in FY2016, it established a voluntary Nomination Committee and Remuneration Committee, with the majority of the Committee members being outside Directors and outside Audit & Supervisory Board Members. In FY2018, the Company formulated a successor plan for candidates for Executive Directors at the time.

Based on this foundation, JSF transitioned to a Company with a Nomination Committee, etc. in FY2019. The aim of this was to separate supervision from execution to create a system that would enable the Company to push forward with its management policies. It would be comprised of the Board of Directors being responsible for determining and supervising management policies such as the Medium-term Management Plan, and an execution side composed of the Executive Committee under the supervision of the Representative Executive Officer & President. This would allow for prompt and effective decisions. Therefore, from the outset, the chairpersons of the Board of Directors and the three statutory committees were all outside Directors, and the majority of the Directors were independent outside Directors.

Under the basic framework as a Company with a Nomination Committee, etc., JSF has made various efforts to improve its effectiveness accordingly. Among them, the most important efforts are as follows:

Based on this foundation, JSF transitioned to a Company with a Nomination Committee, etc. in FY2019. The aim of this was to separate supervision from execution to create a system that would enable the Company to push forward with its management policies. It would be comprised of the Board of Directors being responsible for determining and supervising management policies such as the Medium-term Management Plan, and an execution side composed of the Executive Committee under the supervision of the Representative Executive Officer & President. This would allow for prompt and effective decisions. Therefore, from the outset, the chairpersons of the Board of Directors and the three statutory committees were all outside Directors, and the majority of the Directors were independent outside Directors.

Under the basic framework as a Company with a Nomination Committee, etc., JSF has made various efforts to improve its effectiveness accordingly. Among them, the most important efforts are as follows:

(1) Formulated and announced the Sixth Medium-term Management Plan and performance-linked remuneration for Officers

The Sixth Medium-term Management Plan was centered on promoting the diversification of revenue sources by expanding and strengthening the securities financing and trust business, and accordingly set management targets such as the number of loanable issues and basic profit. The company also introduced performance-linked remuneration for Officers in line with this Plan.

(2) Formulated and announced the medium-term management policies

In FY2021, JSF formulated and announced medium-term management policies to ensure a further level of commitment and transparency to sustainable growth and medium- to long-term corporate value enhancement. In the policy, the Company estimated the cost of equity to be in the mid-4% range, set a management target to achieve a ROE of over 5% by FY2025, above the estimated cost of equity, and set a target of achieving a total payout ratio of 100% by FY2025.

(3) Formulated and announced our approach to the structure of the Board of Directors

Amidst the changing environment of globalization and digital transformation, JSF has decided on a policy of structuring the Board of Directors that is attentive to the diversification of skills, the balance between supervision and execution in terms of personnel, and the diversity of age and gender, in order to formulate its management plans under the medium-term management policy and further exercise supervisory functions (described below).

(4) Formulated and announced our approach to the appointment of Executive Officers (described below)

(5) Formulated and announced our basic approach concerning our business portfolio

The Group's business portfolio consists of the securities financing business, which is centered on margin loan transactions, the securities investment business, the trust business, and the real estate management business.

(6) Formulated and announced our basic approach to sustainability

By providing various services, such as the margin loan business, as an infrastructure for securities and financial markets, the JSF Group aims to contribute to the realization of a sustainable society, including providing support to market participants who are engaged in similar initiatives.

(7) Strengthened the secretariat function of the Board of Directors

In FY2021, a Corporate Governance Office was established with the perspective of promptly addressing various issues in corporate governance and further strengthening the secretariat function of the Board of Directors. The Office fulfills a secretariat function in the Nomination Committee, Remuneration Committee, and the Directors' deliberations on the various measures mentioned above.

2. Approach to the Appointment of its Management

Team JSF believes that the roles expected of its management team, centered around the Representative Executive Officer & President, change over time depending on the environment in which the Company operates and its business portfolio. With this in mind, the appointment of our management team and succession planning are structured based on our approach concerning its business portfolio, as follows:

(1) JSF's aims for business expansion

In the Company's business portfolio, there are roughly two major areas that are particularly important for future corporate value enhancement.

- Operation of a margin loan transactions system

The margin loan business is the foundation and raison d'etre of the Company's existence as a licensed business under the Financial Instruments and Exchange Act. JSF will continue to maintain and strengthen this by appropriately responding to the changing business environment surrounding the stock market and properly understanding the trading requirements of market participants.

- Securities financing business and trust business

In the security financing business, JSF is actively responding to the expansion of transactions with domestic and overseas market participants by leveraging its background in margin loan transactions and other services. Specifically, we are expanding the number of business partners, and the currencies and securities covered. To achieve this, we are actively engaged in areas of cross-border securities loans through international forums such as PASLA (Pan Asia Securities Lending Association) and ISLA (International Securities Lending Association). In the trust business, we are also expanding our business by focusing on so-called custodian type trusts, such as conservation trusts, and by taking advantage of our mobility and flexibility to gain a high market share in niche areas. These operations are expected to make a significant contribution to the Company's future profitability.

(2) Qualities considered important for each business portfolio (Attachment 2)

- Margin loan transactions system

Because margin loan transactions systems are widely used by securities companies, the qualifications required for its administration place emphasis on its public role, impartiality, and neutrality. In addition to this, going forward, there will be a demand for a flexible response to the changing business environment and participants’ needs, as well as for uncovering of participants' new requirements in this field. Actually, in FY2023, a project team is scheduled to be established to consider the ideal method of margin loan transactions from this viewpoint from a medium- to long-term perspective.

- Securities financing, etc.

Since the securities financing business and trust business also have an extensive range of market participants, we believe that the qualities required are also appropriate for JSF, which supports the securities and financial market infrastructure. However, knowledge and experience related to securities and financial business, markets, and technological innovations, as well as international expertise, are even more important qualities.

(3) Approach to the structure of the management team

Based on such future business developments and the required qualifications, the composition of the management team is currently being organized as follows:

- Execution

JSF will build an overall executive system with the qualities sought after so that the above business development can effectively progress by combining the strengths and talents of each individual Executive Officer. The required qualities of the entire Executive Team are organized as having a thorough recognition of their public role, extensive knowledge of the market in general, familiarity with various laws and regulations, knowledge of the Company’s highly specialized operations, international expertise, advanced knowledge of business management, risk management, and financial accounting, and flexibility in responding to the changing business environment.

- Supervision

After establishing a skills matrix to enable effective supervision of the above execution, we will structure a team of Directors taking into consideration the multi-layering of skills and diversification in age and gender. In recent years, experience in corporate management in the financial and industrial sectors, specialized knowledge such as law, and expertise in digital transformation and innovative business have been emphasized.

(4) Approach to succession planning for the Representative Executive Officer & President

Among the above-mentioned succession plans for the executive-side management team, the succession plan for the Representative Executive Officer & President, which is particularly important, is as follows:

- Required qualities of the Representative Executive Officer & President

In addition to the above qualities sought after in an Executive Officer, one must be prepared to execute business for the enhancement of corporate value, and have high ethical standards as the representative of a company that plays a public role.

- Approach to succession planning for the Current Representative Executive Officer & President under the current situation

Based on the above direction, which positions securities financing and other businesses as a growth area, and the structure of Executive Team as a whole, JSF is conducting a review centering on internal personnel, including employees hired mid-career, and not including those from the public sector, with more emphasis on knowledge and experience in securities and financial operations, including technological innovations.

3. Management Team Appointment Process and the Role Played by the Nomination Committee and the Board of Directors

The appointment of the management team is one of the most important missions of the Nomination Committee and Board of Directors, and this Committee and Board of Directors are independently and actively engaged in the following management nomination processes:

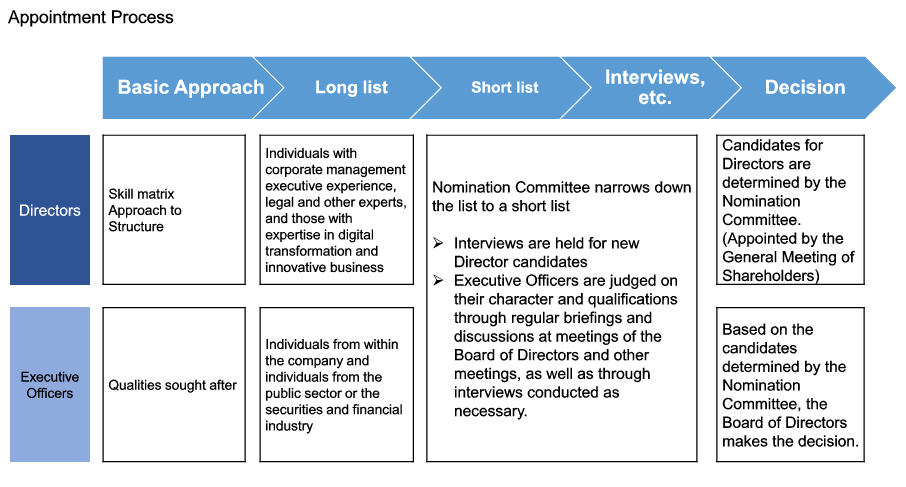

(1) Appointment processes (Attachment 3)

i) Deliberation and determination of the basic qualitative requirements

The Nomination Committee and Board of Directors will deliberate and determine the “Approach to the structure of the Board of Directors,” the skill matrix for Directors, and the “Approach to the appointment of Executive Officers," and establishes the required qualities as described above.

ⅱ) Long list discussions

Discussions are held on a long list of the population. In the case of directors, individuals with corporate management executive experience, legal and other experts, and those with expertise in digital transformation and innovative business, and in the case of Executive Officers, those from within the company and outside persons (e.g., those from the public sector and those from the securities and financial industry).

ⅲ) Narrowing down and finalizing the list to a short list

Following this, the Nomination Committee narrows down the candidates to a shortlist based on their background, expertise, and evaluation. The final decision is then made based on this shortlist.

The Nomination Committee and Board of Directors will deliberate and determine the “Approach to the structure of the Board of Directors,” the skill matrix for Directors, and the “Approach to the appointment of Executive Officers," and establishes the required qualities as described above.

ⅱ) Long list discussions

Discussions are held on a long list of the population. In the case of directors, individuals with corporate management executive experience, legal and other experts, and those with expertise in digital transformation and innovative business, and in the case of Executive Officers, those from within the company and outside persons (e.g., those from the public sector and those from the securities and financial industry).

ⅲ) Narrowing down and finalizing the list to a short list

Following this, the Nomination Committee narrows down the candidates to a shortlist based on their background, expertise, and evaluation. The final decision is then made based on this shortlist.

(2) Independent and active involvement of the Nomination Committee in the above processes

The Nominating Committee gathers information during various opportunities such as regular briefings and discussions at the Board of Directors, inspection tours, and briefings prior to the Board of Directors meeting from the executive side. The Committee also exchanges opinions with outside Directors (excluding the Director who also serves as the Representative Executive Officer & President) through activities such as outside Director Liaison Committee meetings.

Based on this understanding of the Company's operations and candidate personnel, as well as proactive questioning from the supervisory side and a review and proposals by the executive side in response to such questioning, the various deliberations and decisions indicated in 1 above are effectively carried out.

As an example, JSF disclosed its current view regarding succession planning for the current President, which is to consider internal personnel, including employees hired mid-career, not including those from the public sector, as the current policy in January 2023. In this regard, this point was already raised by the Nomination Committee in the summer of 2022 during an informal exchange of views between the Nomination Committee and the Executive team. On the other hand, on the Executive team side as well, a similar awareness of the issue had emerged during the process of establishing our thinking on our business portfolio and our thoughts on appointing Executive Officers based on this thinking since 2021, and a basic understanding was reached between the Supervisory and Executive sides. Based on these considerations, the succession plan for the Representative Executive Officer & President was discussed and disclosed in January 2023 after being approved by the Nomination Committee and the Board of Directors.

For important matters, including the aforementioned cases, decisions are made after several rounds of discussions, with the Supervisory side proposing and raising issues to the Executive sides, in the form of deliberations on (1) organization of the issues and free discussion, (2) discussions on the draft proposals, and (3) deliberation on the resolutions and disclosure.

Based on this understanding of the Company's operations and candidate personnel, as well as proactive questioning from the supervisory side and a review and proposals by the executive side in response to such questioning, the various deliberations and decisions indicated in 1 above are effectively carried out.

As an example, JSF disclosed its current view regarding succession planning for the current President, which is to consider internal personnel, including employees hired mid-career, not including those from the public sector, as the current policy in January 2023. In this regard, this point was already raised by the Nomination Committee in the summer of 2022 during an informal exchange of views between the Nomination Committee and the Executive team. On the other hand, on the Executive team side as well, a similar awareness of the issue had emerged during the process of establishing our thinking on our business portfolio and our thoughts on appointing Executive Officers based on this thinking since 2021, and a basic understanding was reached between the Supervisory and Executive sides. Based on these considerations, the succession plan for the Representative Executive Officer & President was discussed and disclosed in January 2023 after being approved by the Nomination Committee and the Board of Directors.

For important matters, including the aforementioned cases, decisions are made after several rounds of discussions, with the Supervisory side proposing and raising issues to the Executive sides, in the form of deliberations on (1) organization of the issues and free discussion, (2) discussions on the draft proposals, and (3) deliberation on the resolutions and disclosure.

4. Development Policies for Internal Human Resources

To ensure the effectiveness of such a management succession plan, it is crucial to cultivate a small but robust group of elite internal human resources, who can potentially serve as that population. In light of discussions at the Nomination Committee and the Board of Directors, JSF takes the following approach to development policies for internal human resources.

(1) Basic approach

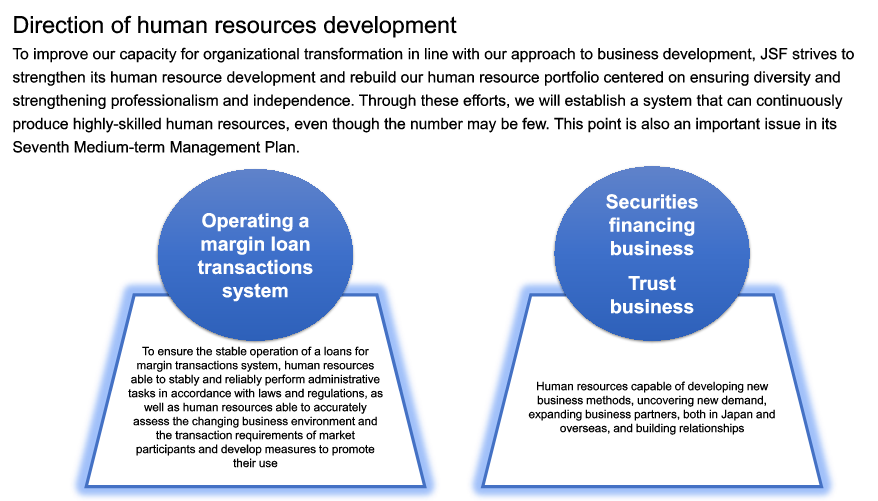

To improve our capacity for organizational transformation in line with our approach to business development, JSF strives to strengthen its human resource development and rebuild our human resource portfolio centered on ensuring diversity and strengthening professionalism and independence. Through these efforts, we will establish a system that can continuously produce highly-skilled human resources, even though the number may be few. This point is also an important issue in its Seventh Medium-term Management Plan, and the company plans to soon announce its human resource strategy for the plan.

(2) Direction of human resources development (Attachment 4)

We believe that human resource development needs to be considered on a business-line specific basis, in line with our business portfolio. As stated in 2.(1) above, the following types of human resources are required for each of the two fields that are considered important for our future business development.

ⅰ) Operating a margin loan transactions system

To ensure the stable operation of a margin loan transactions system, human resources able to stably and reliably perform administrative tasks in accordance with laws and regulations, as well as human resources able to accurately assess the changing business environment and the transaction requirements of market participants and develop measures to promote their use.

ⅱ) Securities financing business and trust business

Human resources capable of developing new business methods, uncovering new demand, expanding business partners both in Japan and overseas, and building relationships.

To ensure the stable operation of a margin loan transactions system, human resources able to stably and reliably perform administrative tasks in accordance with laws and regulations, as well as human resources able to accurately assess the changing business environment and the transaction requirements of market participants and develop measures to promote their use.

ⅱ) Securities financing business and trust business

Human resources capable of developing new business methods, uncovering new demand, expanding business partners both in Japan and overseas, and building relationships.

(3) Initiatives for specific human resource development

JSF has a long history of operating a margin loan transactions system, originally designed to provide liquidity to the stock market. Margin loan transactions involve lending funds secured by stocks or lending stocks secured by funds, with securities companies as business partners, and in the broadest sense, it is a form of security financing. JSF's human resources, who have accumulated know-how through years of experience in this type of work, are well equipped to carry out security financing operations.

Building on this foundation, in order to expand securities financing business more broadly, it is necessary to increase the number of counterparties, particularly overseas, expand the currencies and securities lent and borrowed, and enhance the sophistication of transaction methods. For this reason, the Company has been continuously dispatching its officers and employees to international securities lending forums such as PASLA and ISLA for several years, for example, and has expanded the number of forums in which it participates to cover North America and Europe as well as Asia. In the process, the motivation to acquire language skills and more advanced knowledge and experience in securities and financial operations has improved, especially among younger staff members, and their skills have actually been steadily enhanced. This improvement in human resources has significantly contributed to the growth of securities financing operations in recent years.

Furthermore, JSF has recently been actively working to hire mid-career employees. The Company intends to further introduce outside knowledge and expertise, including this, and to spread such knowledge and expertise to internal personnel through on-the-job training, with this as the core.

Actually, an individual who joined the company as a mid-career employee from a financial institution and has experience as a general manager and executive officer was promoted to the position of Managing Executive Officer in FY2022, and is scheduled to be promoted to Senior Managing Executive Officer in FY2023.

Building on this foundation, in order to expand securities financing business more broadly, it is necessary to increase the number of counterparties, particularly overseas, expand the currencies and securities lent and borrowed, and enhance the sophistication of transaction methods. For this reason, the Company has been continuously dispatching its officers and employees to international securities lending forums such as PASLA and ISLA for several years, for example, and has expanded the number of forums in which it participates to cover North America and Europe as well as Asia. In the process, the motivation to acquire language skills and more advanced knowledge and experience in securities and financial operations has improved, especially among younger staff members, and their skills have actually been steadily enhanced. This improvement in human resources has significantly contributed to the growth of securities financing operations in recent years.

Furthermore, JSF has recently been actively working to hire mid-career employees. The Company intends to further introduce outside knowledge and expertise, including this, and to spread such knowledge and expertise to internal personnel through on-the-job training, with this as the core.

Actually, an individual who joined the company as a mid-career employee from a financial institution and has experience as a general manager and executive officer was promoted to the position of Managing Executive Officer in FY2022, and is scheduled to be promoted to Senior Managing Executive Officer in FY2023.

(4) Commitment of Nomination Committee and Board of Directors

The Nomination Committee and the Board of Directors are actively discussing the issue with the awareness that the Company's human resources are required to be capable of autonomous conceptualization and organizational reform, and that it is desirable to enhance corporate value in a way that is supported by such qualities.

In concrete terms, with regard to human resource development under the Seventh Medium-term Management Plan, the Nomination Committee discussed and raised with the Executive Committee the need to develop both human resources who conduct their duties in a prudent manner, and those who can proactively and actively respond to the changing business environment, including responding to new business opportunities, in line with the corresponding business lines. It also raised the need to achieve a comprehensive balance between the two. These proposed issues are reflected in the Medium-term Management Plan and the human resources strategy that will soon be developed and announced based thereon.

Also, at the draft stage prior to the publication of the Integrated Report in November 2022, outside Directors expressed the opinion that there is a need to enhance the disclosure of non-financial information, particularly with respect to the Company's approach to human capital. The preparation of this public disclosure document is in line with this awareness, and will be incorporated into the Integrated Report for FY2023 and thereafter.

As outlined above, we have summarized our efforts to enhance our corporate value and to improve our sustainability as a corporate entity through the development of human resources, including the management team, who will support the enhancement of our corporate value. We will continue to actively address these issues in order to strengthen corporate governance and thereby enhance our medium- and long-term corporate value. We appreciate the understanding and support of all stakeholders in this regard.

In concrete terms, with regard to human resource development under the Seventh Medium-term Management Plan, the Nomination Committee discussed and raised with the Executive Committee the need to develop both human resources who conduct their duties in a prudent manner, and those who can proactively and actively respond to the changing business environment, including responding to new business opportunities, in line with the corresponding business lines. It also raised the need to achieve a comprehensive balance between the two. These proposed issues are reflected in the Medium-term Management Plan and the human resources strategy that will soon be developed and announced based thereon.

Also, at the draft stage prior to the publication of the Integrated Report in November 2022, outside Directors expressed the opinion that there is a need to enhance the disclosure of non-financial information, particularly with respect to the Company's approach to human capital. The preparation of this public disclosure document is in line with this awareness, and will be incorporated into the Integrated Report for FY2023 and thereafter.

As outlined above, we have summarized our efforts to enhance our corporate value and to improve our sustainability as a corporate entity through the development of human resources, including the management team, who will support the enhancement of our corporate value. We will continue to actively address these issues in order to strengthen corporate governance and thereby enhance our medium- and long-term corporate value. We appreciate the understanding and support of all stakeholders in this regard.